UK Retail Market after Brexit

Brexit-the withdrawal of the United Kingdom from the European Union-has deeply affected many sections of the economy of the United Kingdom, one of which is retail. Among the strong pillars that hold up the UK economy, the retail market received a strong blow after the announcement of Brexit. The aftermath effects range from supply chain disruptions and labor shortages to increased costs in goods and services. We shall be looking, in this article, at how terrible the retail market was affected post-Brexit, what experts were saying, the statistics then, and probable solutions that could bring the sector back on its feet. Furthermore, we will also be able to look at how young workers can join the retail market in 2024. Our paper looks at the immediate impact of Brexit on the Retail Market.

The immediate impact of Brexit on the Retail Market.

The most prominent Brexit effect on UK retailers came in supply chain disruptions. The UK, no longer part of the EU’s single market and customs union, means new trade barriers went into effect, creating delays at ports, increased customs checks, and additional paperwork. Retailers that depend on imported goods from Europe had to accept considerable delays and higher importing costs. This would have a return effect on everything from fashion retailers to grocery chains, leading to stock shortages and increased costs for the consumer.

UK retail prices were up an average 1.5% in the post-Brexit year, according to the British Retail Consortium, as retailers passed on increased import costs. More pronounced increases were seen across some categories, such as food and drink. Those retailers that enjoyed frictionless trade with the EU had to manage new tariffs, duties, and regulations, raising operational complexity and therefore the cost of doing business.

Labor shortages also became high. Many retail workers in the UK were EU nationals, especially in customer service, warehousing, and logistics jobs. Post-Brexit immigration rules, which put additional constraints on EU workers, reduced the supply of foreign workers into retail. This shortage of labor forced many businesses to cut working hours, delay deliveries, and raise wages to attract domestic workers-a move that further inflated costs.

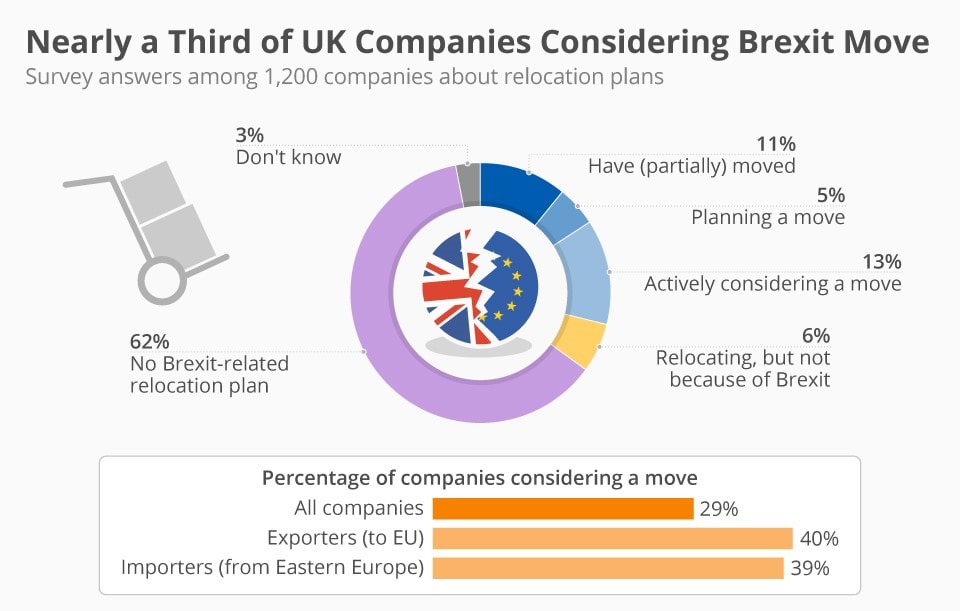

Statistics That Show How Devastating Brexit Has Been The numbers tell a clear story. According to the statistics from the ONS, the volume of retail sales in the UK in 2021 plunged by 3.7% from the previous year, the first after Brexit. Much was from supply chain problems and an increase in the price of goods. According to estimates, KPMG- one of the leading auditing firms-estimated that about 30% of UK retailers reported serious supply chain disruptions linked to Brexit, while over 40% were confronted with increased costs for importing goods from the EU.

The FDF estimated that imports from the EU were down 15% in 2021, while UK food exports to the EU were as low as 25% down. This sharp reduction in trade with Europe means retailers are looking elsewhere for supplies, often considerably more expensive, which are passed on to the consumer.

Expert Opinion of the Retail Market Challenges After Brexit

Some experts in economics and retail have shown apprehension regarding the long-term impact of Brexit on the retail market in the UK. To quote Helen Dickinson, Chief Executive of the British Retail Consortium, “Brexit has introduced a raft of new challenges for retailers, from higher costs and logistical delays to complex import regulations.”. Many businesses have been forced to radically revamp their supply chain strategies, while smaller retailers are often barely able to keep their heads above water under the new burdens.

One of the economic issues is lower migration: Jonathan Portes, Professor of Economics at King’s College London, observed that “The restrictions on EU workers have created gaps in key areas like retail and logistics, where many businesses rely on flexible, low-cost labor. Unless that gap is filled, the retail sector is likely to suffer further contractions, since businesses are unable to find the staff they need.”

How the UK Can Fix the Retail Market

Following are some of the ways in which the impact of Brexit on the retail sector could be somewhat minimized.

Supply Chain Resilience: UK retailers become less dependent on EU imports by diversifying their supply chains-source more products locally or from countries outside of the EU. This could be helped by increasing local manufacturing capacity to reduce risks from delays to supply chains and tariffs. Government incentives may also help facilitate this through things like tax breaks or grants for businesses improving local supply chains.

Better Trade Agreements: The UK can work out trade agreements with non-EU nations for the facilitation of importing and exporting goods. A reduction in tariff, coupled with simplification of customs through bilateral agreements with leading trading nations like the US, Canada, and Australia will enable the retailer to access new markets and at lower costs.

Address Labor Shortages: The retail industry requires a more elastic immigration policy to attract immigrant labor, particularly in those locations where there is evidence of labor shortage. Other means that retailers would consider filling vacancies in warehousing, logistics, and customer service are temporary work visas or sector-specific immigration programs.

Automation and Technology: Investment in automation and digital technologies could be a help for retailers to reduce dependency on labor and improve their operational efficiencies. For instance, warehouse automation and instore self-checkout systems are probably necessary to manage the labor shortages and help cut down costs.

Government Incentives: The government can support failing retailers with finance, especially small business retailers. This may include things like bursaries or loans for increased costs or investment in new technologies. There’s also a need to simplify post-Brexit regulations and make available appropriate training for businesses on how to deal with these new trade rules in order to ease this transition process.

How Young Workers Can Enter the Retail Market in 2024

Even today, in 2024, retail allows jobs to be provided, especially to young workers who are seeking part-time jobs or entry-level positions. According to UK law, the minimum working age is 16 years, though there are specified limitations on the number of hours and types of work that young people can engage in. Such retailers as supermarkets, clothing outlets, and hospitality-related retail can offer flexible jobs suitable for students and younger job candidates.

A template for a retail CV template should express key skills such as customer service, communication, teamwork, and any other part-time work experience related to hospitality or volunteer sectors; this is what will give them the edge in an already competitive market.

Conclusion: The Future of UK Retail Post-Brexit

The UK retail market has had its share of extreme challenges since Brexit-messy supply chains, a shortage of labor, and high increased costs. While severe, the impact can be overcome, and the industry can flourish in the post-Brexit era with the help of various measures: diversification of supply chains, enhancement of trade agreements, filling labor gaps, and technological investments. If appropriately addressed and cushioned, the retail market of the UK is well-placed to continue playing an vital role in the country’s economy, creating employment and rendering services to millions across the country.

In the future, too, young workers will be essential to retail. This market is in transition, and retail needs young workers to provide the flexibility and energy needed for this market’s transition. If appropriately prepared and in possession of a good CV, many possibilities will open themselves up for them within this key sector, too, insofar as it adjusts to the new realities of the post-Brexit world.